|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

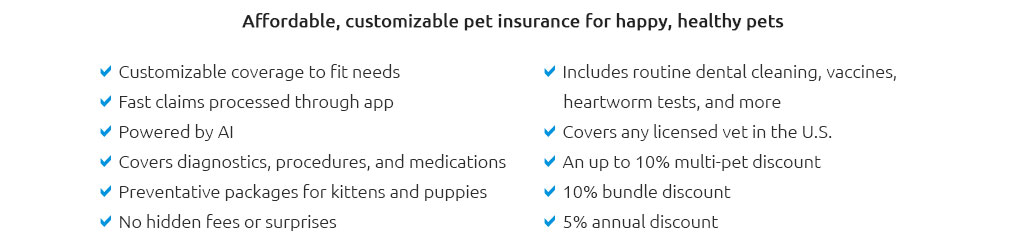

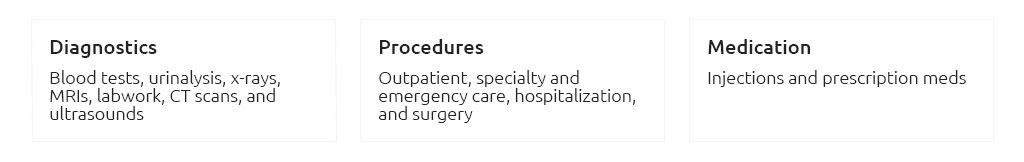

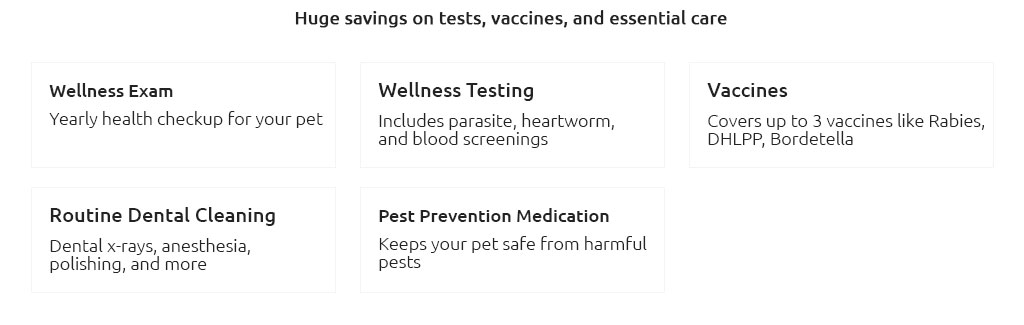

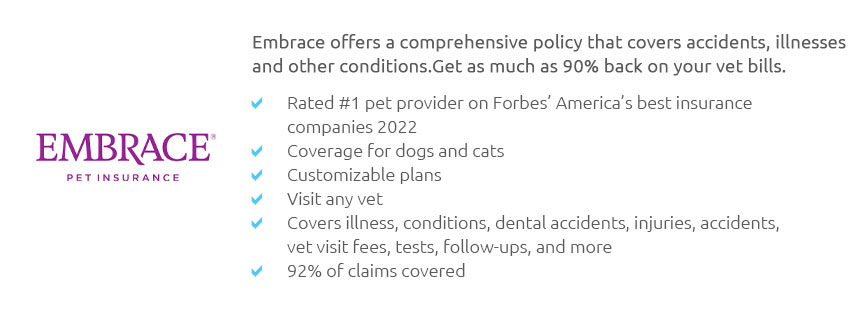

The Cost of Pet Insurance: A Comprehensive GuideIn the modern age, where pets are increasingly considered integral members of the family, the topic of pet insurance has become a subject of great interest. This interest is not without good reason, as the costs associated with veterinary care continue to rise. Understanding the cost of pet insurance requires a nuanced approach, considering various factors that influence premiums and coverage. Let's delve into this intricate world to provide clarity for those considering this important financial decision. First and foremost, it's essential to recognize that pet insurance is designed to mitigate the financial impact of unexpected veterinary bills. However, the cost of pet insurance can vary widely, influenced by several key factors. One of the primary determinants is the type of pet you own. Dogs, for instance, generally incur higher insurance costs than cats due to their propensity for injuries and certain breed-specific health conditions. Furthermore, the age of your pet plays a crucial role; younger animals typically have lower premiums as they are less likely to have pre-existing conditions. Another significant factor is the breed of your pet. Certain breeds are predisposed to specific health issues, which can drive up the cost of insurance. For example, a purebred dog might cost more to insure than a mixed breed due to hereditary conditions. Additionally, where you live can influence costs; urban areas, with their higher veterinary fees, often result in higher insurance premiums. The coverage level you choose also directly impacts the cost. Basic plans covering accidents and illnesses are less expensive than comprehensive plans, which might include wellness checks, vaccinations, and dental care. Deductibles and reimbursement levels further shape your overall expense; a higher deductible usually means lower monthly premiums, while a higher reimbursement level increases them.

When evaluating the cost of pet insurance, it's also wise to consider the potential long-term savings. While paying monthly premiums might seem burdensome, they can prove to be a wise investment should your pet face a significant health crisis. In these instances, the insurance can cover a substantial portion of the costs, potentially saving you thousands of dollars. However, one must also weigh the likelihood of needing such coverage. Some pet owners prefer to set aside funds monthly into a savings account dedicated to pet care. This approach provides financial flexibility without the commitment of monthly premiums, though it lacks the immediate financial support that insurance offers in an emergency. In conclusion, the cost of pet insurance is a multifaceted issue, influenced by factors such as pet type, age, breed, location, and chosen coverage level. While it can be a significant expense, it also offers peace of mind and financial protection against unforeseen veterinary costs. As with any financial decision, it is imperative to assess your pet's specific needs, your financial situation, and your personal risk tolerance to determine whether pet insurance is the right choice for you. By doing so, you ensure that your beloved companion receives the care they deserve without causing undue financial strain. https://www.bankrate.com/insurance/pet-insurance/how-much-does-pet-insurance-cost/

Pet insurance costs depend on your pet, where you live, the plan you choose and several other factors. https://www.nerdwallet.com/article/insurance/cost-of-pet-insurance

The average pet insurance cost is about $56 per month for dogs and $32 per month for cats for the most common type of policy. https://www.metlifepetinsurance.com/blog/pet-insurance/how-much-does-pet-insurance-cost/

As of 2024, the average monthly premium for dog insurance that covers accidents and illnesses has increased to $53 per month.

|